Table of Contents

Ever wondered if your awesome community fundraising efforts are actually following all the rules? You're not alone. It turns out, raising money for a good cause in the United States isn't as simple as setting up a lemonade stand. There's a whole maze of regulations, and they vary from state to state. That's where "Community fundraising compliance in the United States" comes in. Think of it as your cheat sheet to avoid accidentally stepping on legal landmines. This article will walk you through why these rules exist, what happens if you ignore them (spoiler: it's not pretty), and how to make sure your fundraising is squeaky clean. We'll explore the registration process, what you need to disclose, and even some exemptions that might apply to your group. By the end, you’ll know how to navigate the complexities and keep your focus where it should be: on making a difference. Let's get started and make sure your good intentions are backed by good practices.

Why Community Fundraising Compliance Matters

Why Community Fundraising Compliance Matters

Okay, so you're diving into the world of community fundraising, that's fantastic! But here's the thing, it's not just about having a big heart and a great cause. You absolutely need to understand why "Community fundraising compliance in the United States" is so important. Think of it like this: you wouldn't just start building a house without checking the blueprints, right? Well, fundraising has its own set of blueprints – laws and regulations that keep everything fair and above board. These rules aren’t there to be a pain; they're there to protect both the people donating their hard-earned money and the organizations doing the amazing work. Ignoring them is like driving without a license - you might get away with it for a bit, but eventually, the consequences can be pretty rough. It's all about building trust and ensuring that the funds you raise are used for their intended purpose.

Understanding U.S. Charitable Registration Requirements

Understanding U.S. Charitable Registration Requirements

The Registration Reality

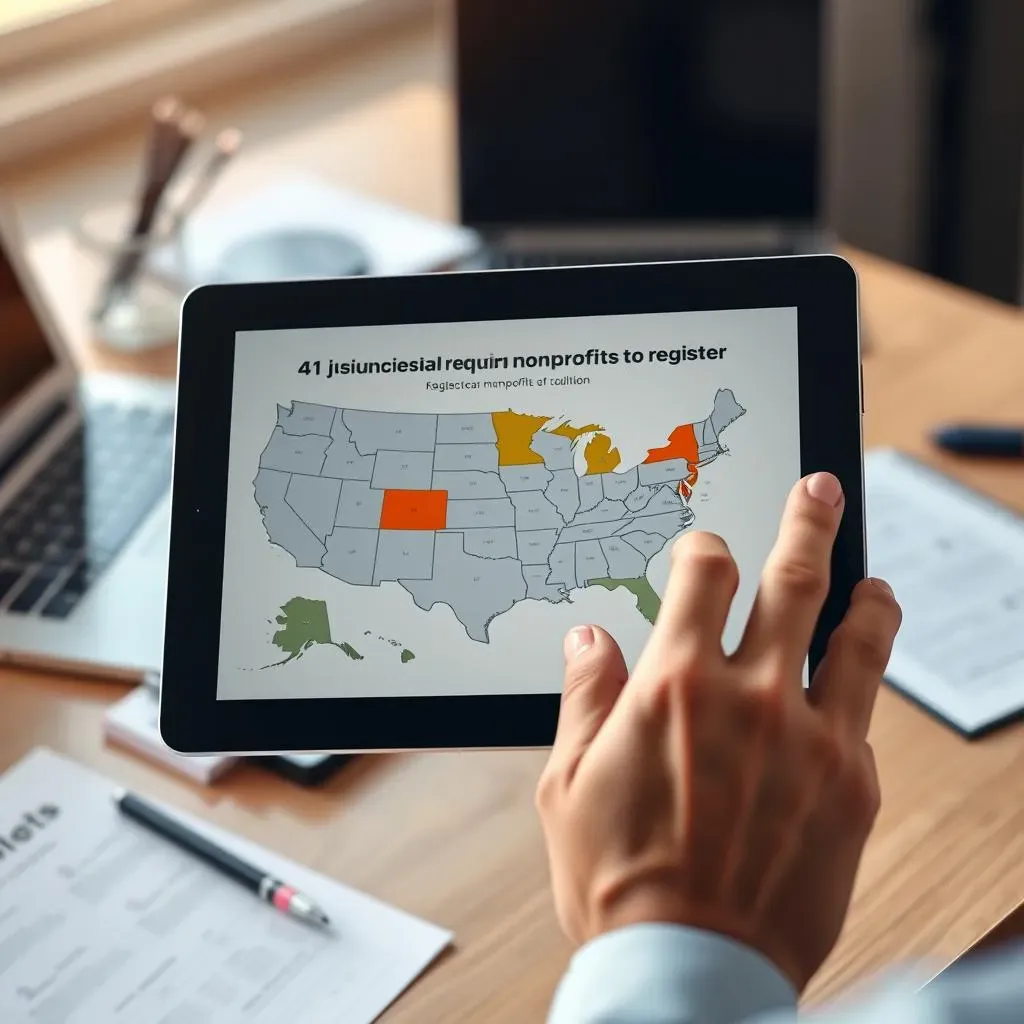

So, you're ready to raise some funds, that's great! But before you start, let's talk about the nitty-gritty: registration. In the U.S., most states require nonprofits to register before they can actually ask the public for money. It’s like getting a permit to operate, but instead of building a shed, you're building a fundraising campaign. This isn't some optional extra; it's the law in about 41 jurisdictions. Each state has its own rules, forms, and fees. It can seem like a lot, but it’s all about making sure you're playing by the book and giving donors confidence that you're a legitimate organization. It’s a bit like getting your car inspected; nobody wants to drive on a road with unsafe cars, right?

What's Involved?

Okay, so what does this registration actually entail? Well, you're going to be filling out some paperwork. Think of it like applying to a really strict club, but instead of a secret handshake, you need to provide details about your organization, like your IRS Form 990, a list of your officers and directors, and sometimes even your bylaws. It’s not just a one-time thing either; most states require you to renew your registration annually, which means submitting updated financial information and other supporting documents. Some states are more complicated than others, so make sure you check the specific requirements for each state where you plan to fundraise. It's a bit like doing your taxes, but for charity, which I guess is a bit more noble.

Requirement | Description |

|---|---|

Initial Registration | Filing paperwork with the state charities bureau. |

Supporting Documents | Providing IRS Form 990, list of officers/directors, etc. |

Annual Renewal | Submitting updated financial information and documents. |

Exemptions and Disclosures

Now, before you start hyperventilating about all the paperwork, there's a tiny bit of good news. Some organizations might be eligible for exemptions from registration. These aren’t just handed out like candy though; you usually need to apply for the exemption, and it often has to be renewed each year. Even if you are exempt from registration, there are still rules to follow. For example, 25 jurisdictions require you to include certain disclosure statements on your written solicitations, including your website. So, even if you're "exempt," you're not off the hook completely. It’s like being exempt from gym class, you still have to attend school, you just don’t have to do the burpees. Getting a handle on these details is key to staying compliant and avoiding unnecessary headaches down the road.

Consequences of NonCompliance in Community Fundraising

Consequences of NonCompliance in Community Fundraising

The Price of Ignoring the Rules

Alright, so you might be thinking, "What's the big deal if I skip a registration or two?" Well, let me tell you, the consequences of not following "Community fundraising compliance in the United States" can be pretty hefty. We're not talking about a slap on the wrist here. States take this stuff seriously, and if you're caught soliciting donations without the proper registration, you could face fines. These aren't just small change either; some states can hit you with penalties that could seriously dent your fundraising efforts. It's kind of like getting a speeding ticket; sure, you might try to sneak by, but if you get caught, it's going to cost you.

But it’s not just about the money. Noncompliance can also lead to civil and criminal actions against your organization. Yes, you heard that right, criminal actions. Imagine having your organization's reputation tarnished, or worse, facing legal battles because you didn’t file the right paperwork. It's a whole lot easier to just follow the rules than to try and untangle a legal mess later. Plus, some states are real sticklers and can even deny you the right to fundraise in their state altogether. Think of it like being banned from your favorite restaurant because you didn't follow their dress code.

The Ripple Effect

The fallout from noncompliance goes beyond just fines and legal battles. It can seriously damage your organization's reputation and erode the trust of your donors. People want to know their money is going to a legitimate cause, and if they find out you've been cutting corners with compliance, they're likely to take their donations elsewhere. It’s like finding out your favorite bakery uses expired ingredients; you're probably not going to buy their pastries anymore. Building trust with donors is essential for any successful fundraising campaign, and noncompliance undermines that trust.

Furthermore, in extreme cases, the IRS could even revoke your tax-exempt status. That's a real game-changer. Losing your tax-exempt status not only means you'll have to start paying taxes, but it also makes it a lot harder to attract donors. No one wants to donate to an organization that isn't a legitimate charity. It's like losing your superhero badge; you can’t save the day without it. So, keeping compliant is not just about avoiding legal trouble; it’s about ensuring your organization can continue to do its amazing work.

Consequence | Impact |

|---|---|

Fines | Financial burden on the organization. |

Civil/Criminal Actions | Legal battles and reputational damage. |

Denial of Fundraising Rights | Inability to solicit funds in certain states. |

Loss of Tax-Exempt Status | Significant financial and operational challenges. |

Eroded Donor Trust | Reduced donations and long-term sustainability issues. |

Simplifying Community Fundraising Compliance

Simplifying Community Fundraising Compliance

Streamlining the Process

Okay, so by now, you're probably thinking, "This is way too complicated; I'd rather just sell cookies!" But hold on a sec, it doesn't have to be a total headache. There are definitely ways to make "Simplifying Community Fundraising Compliance" a lot less painful. One of the biggest hurdles is keeping track of all the different state requirements. Each state has its own forms, deadlines, and fees. It’s like trying to remember a bunch of different passwords, and if you get one wrong, it's a hassle. The trick is to get organized. Think about creating a spreadsheet to track your registration status in each state, including deadlines and required documents. Being organized is like having a map; it makes the journey a whole lot easier.

Another tip is to gather all your required documents in one place. This includes things like your IRS determination letter, your bylaws, and your financial statements. It’s a bit like packing for a trip; you don’t want to be scrambling for your toothbrush at the last minute. Having everything ready to go will save you a ton of time and stress when you actually start the registration process. And remember, many states have online portals where you can submit your applications, which can make the process a bit smoother. So, take a deep breath, get organized, and let's tackle this together.

Leveraging Technology and Services

Now, if all that sounds like too much, you're in luck. There are tools and services out there that can do a lot of the heavy lifting for you. Think of it like hiring a personal assistant for your fundraising compliance. Some software platforms can help you track your registrations, manage your deadlines, and even file your paperwork for you. It’s like having a robot butler that takes care of all the boring tasks. These tools can be a real game-changer, especially if you’re fundraising in multiple states. They can help you stay organized, avoid missed deadlines, and keep everything in order.

There are also fully managed charitable solicitation registration services that handle the entire process for you, from initial application to annual renewals. It's like having a team of experts that knows all the ins and outs of fundraising compliance. These services can be a bit of an investment, but they can save you a ton of time and stress, and they can help you avoid costly mistakes. It’s a bit like paying someone to assemble your furniture; it’s worth it to avoid the frustration and potential for error. If you can afford it, these services are definitely something to consider.

Staying Informed and Proactive

Finally, remember that the rules for "Community fundraising compliance in the United States" are constantly changing. States add, change, and remove laws all the time, so it’s crucial to stay updated. It’s like trying to learn a new language; you can’t just learn it once and forget about it. Make sure you subscribe to newsletters from relevant organizations, attend webinars, and check for updates on state government websites. Being proactive is key to avoiding any nasty surprises. It’s a bit like checking the weather forecast before going on a hike; it helps you prepare for what’s ahead.

Also, consider joining a community of other non-profit professionals. They can share their experiences, offer advice, and provide support. It’s like having a study group for fundraising compliance. We all learn from each other, and you don’t have to go through this alone. Remember, compliance isn't just a set of rules; it’s about building trust and ensuring your organization can continue to do its amazing work. So, stay informed, stay proactive, and keep making a positive impact in your community. It's all worth it in the end.

Tip | Description |

|---|---|

Spreadsheet Tracking | Use a spreadsheet to manage registration status in each state. |

Document Organization | Gather all required documents in one place. |

Software Platforms | Use software to track registrations and manage deadlines. |

Managed Services | Consider a full-service provider for registration and renewals. |

Stay Updated | Subscribe to newsletters and check state government websites. |